Where the wealth make their move

What we do

WHITE ROAD INVEST

WRI

The Company uses Shareholder funds to invest and trade on their behalf (without attracting/using any 3rd party funds).

The business activity "Trading proprietary funds on regulated exchanges " allows to trade in FX, OTC and Exchange Traded Derivatives on the regulated exchanges.

The business activity "Investments in commercial enterprises" allows to make equity investments/acquisitions of business located both in and outside of UAE.

The business activity "Trading proprietary funds on regulated exchanges " allows to trade in FX, OTC and Exchange Traded Derivatives on the regulated exchanges.

The business activity "Investments in commercial enterprises" allows to make equity investments/acquisitions of business located both in and outside of UAE.

ABOUT US.

White Road Invest DMCC was established on in 2022 under the jurisdiction of the Dubai Multi Commodities Centre in order to proceed with the following activities:

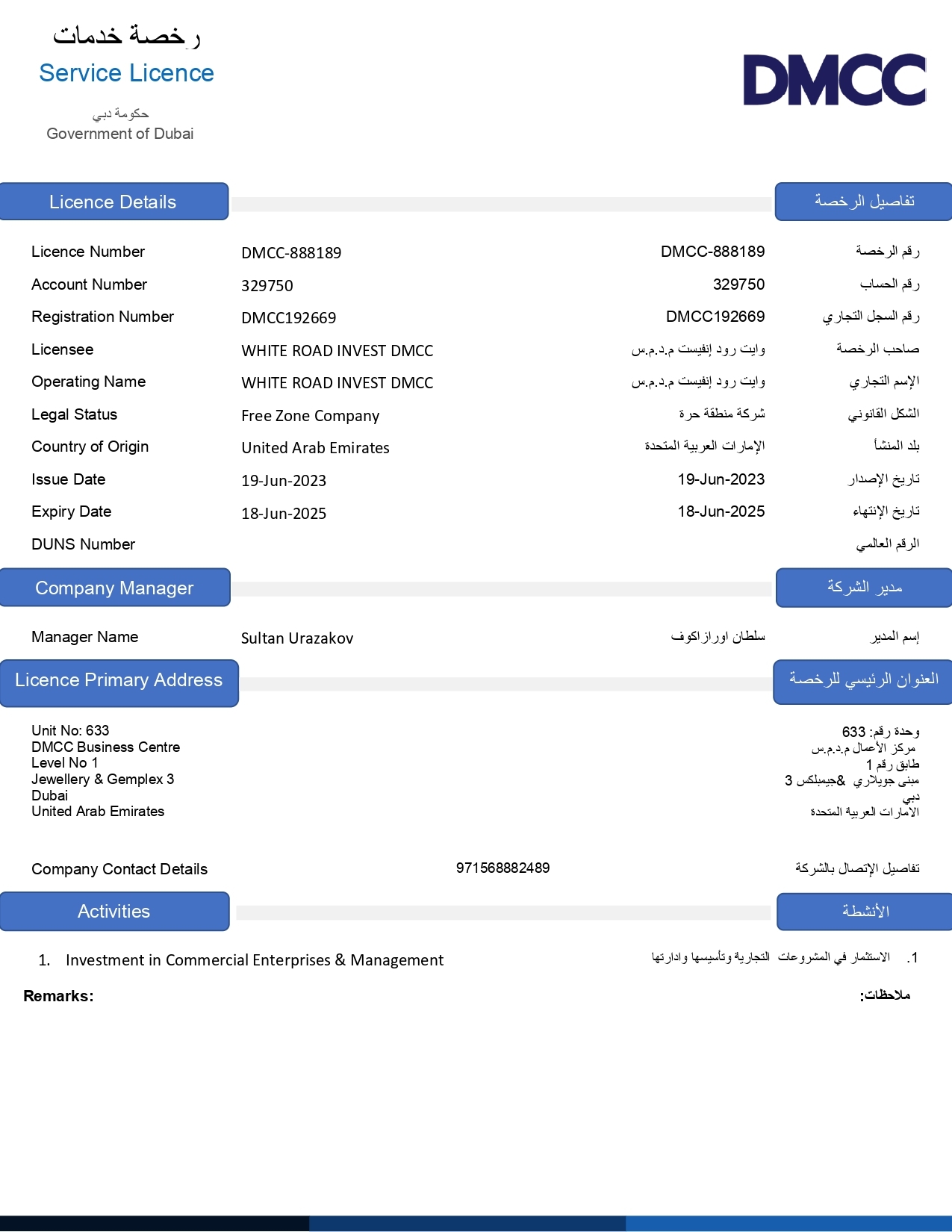

• Investment in Commercial Enterprises and Management

License No: DMCC-888189;

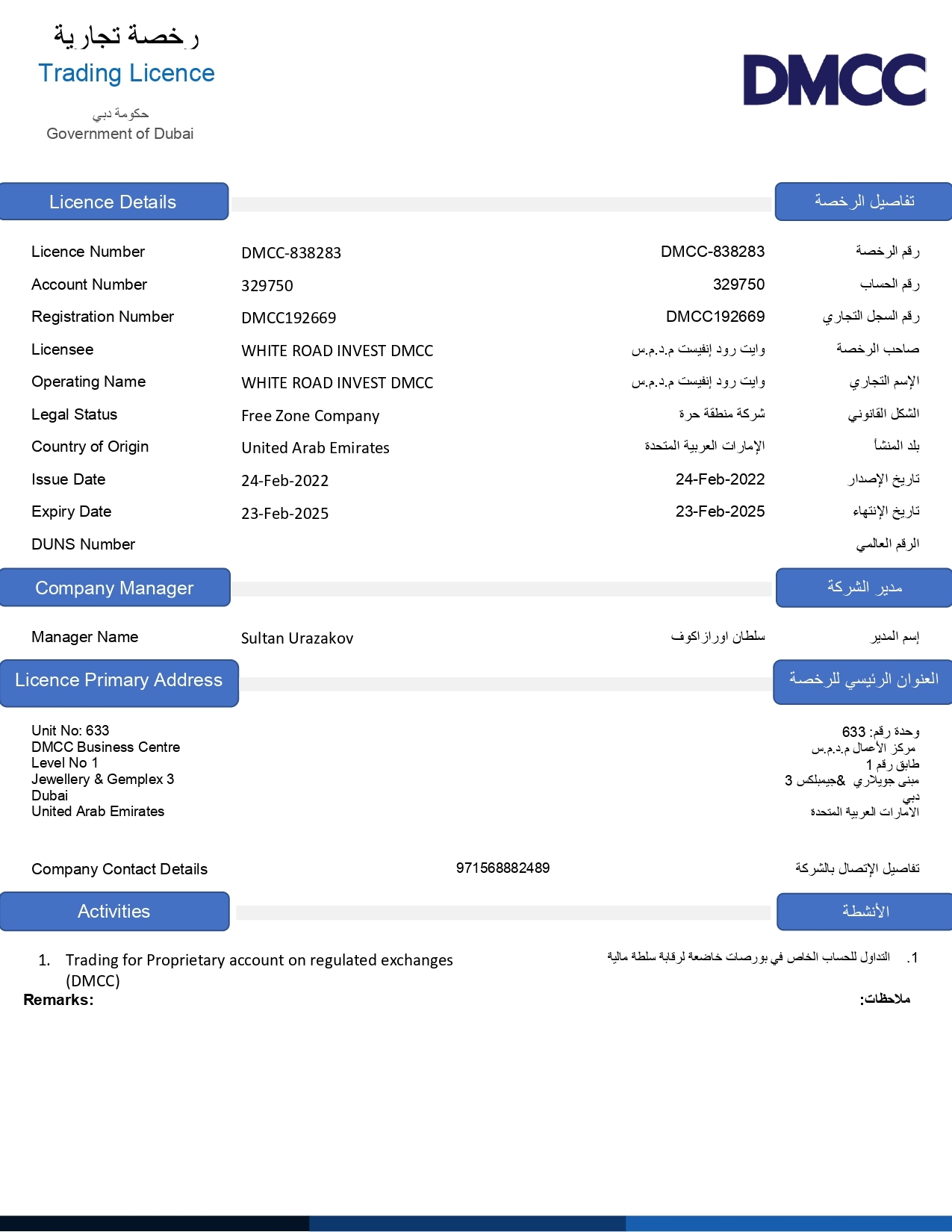

• Trading for Proprietary account on regulated exchanges

License No: DMCC-838283.

White Road Invest DMCC was established on in 2022 under the jurisdiction of the Dubai Multi Commodities Centre in order to proceed with the following activities:

• Investment in Commercial Enterprises and Management

License No: DMCC-888189;

• Trading for Proprietary account on regulated exchanges

License No: DMCC-838283.

Strategy for Investment in Commercial Enterprises:

We aim to create sustainable wealth for our shareholders by managing a diverse portfolio of fundamentally focused investments with a balanced risk profile.

Operating across multiple industry sectors, we build investments portfolio by identifying emerging industries, selecting high-value investment opportunities for growth and sustainable returns.

Each investment is subject to a diligent analysis of its capabilities and resources, financial ratios, and potential for growth.

We are committed to leveraging our experience in operational management, industrial knowledge and our professional network to turn promising opportunities and innovative ideas into tangible prosperous interests.

Operating across multiple industry sectors, we build investments portfolio by identifying emerging industries, selecting high-value investment opportunities for growth and sustainable returns.

Each investment is subject to a diligent analysis of its capabilities and resources, financial ratios, and potential for growth.

We are committed to leveraging our experience in operational management, industrial knowledge and our professional network to turn promising opportunities and innovative ideas into tangible prosperous interests.

Strategy for securities trading on regulated exchange:

The Company’s investment goal is to achieve above-the-market returns via active management through a multi-asset investment strategy leveraging in-house capabilities, as well as external portfolio managers.

The Company has a flexibility to invest in money market instruments, shares, ETFs, ETNs, government bonds, investment grade corporate bonds in addition to derivatives traded in regulated exchanges.

The Company’s investment management has a significant degree of freedom to invest outside its principal geographies, market sectors, industries, or asset classes.

The investment activities are based on the following principles:

• Well diversified portfolios across sectors, instruments, and geographies;

• Fundamental research to identify the highest quality instruments;

• Bottom-up review looking for mispriced options;

The Company has a flexibility to invest in money market instruments, shares, ETFs, ETNs, government bonds, investment grade corporate bonds in addition to derivatives traded in regulated exchanges.

The Company’s investment management has a significant degree of freedom to invest outside its principal geographies, market sectors, industries, or asset classes.

The investment activities are based on the following principles:

• Well diversified portfolios across sectors, instruments, and geographies;

• Fundamental research to identify the highest quality instruments;

• Bottom-up review looking for mispriced options;

LICENSES